March 2, 2022 – In 2016, the trust account rules were modified to define electronic transactions and provide “lawyers with significantly more flexibility with respect to electronic transactions in connection with trust accounts.”1

Since then, many continuing legal education sessions,2 resources,3 and consultations4 have been devoted to answering questions on how to process electronic payments from clients.

To help lawyers and their staff more easily determine how to properly process payments, State Bar of Wisconsin Ethics Counsel Aviva Meridian Kaiser has created three flow charts: The Electronic Banking chart, Trust Account Options chart, and Payment from Client chart.

Here’s more about them and where to find them:

The Electronic Banking Flow Chart

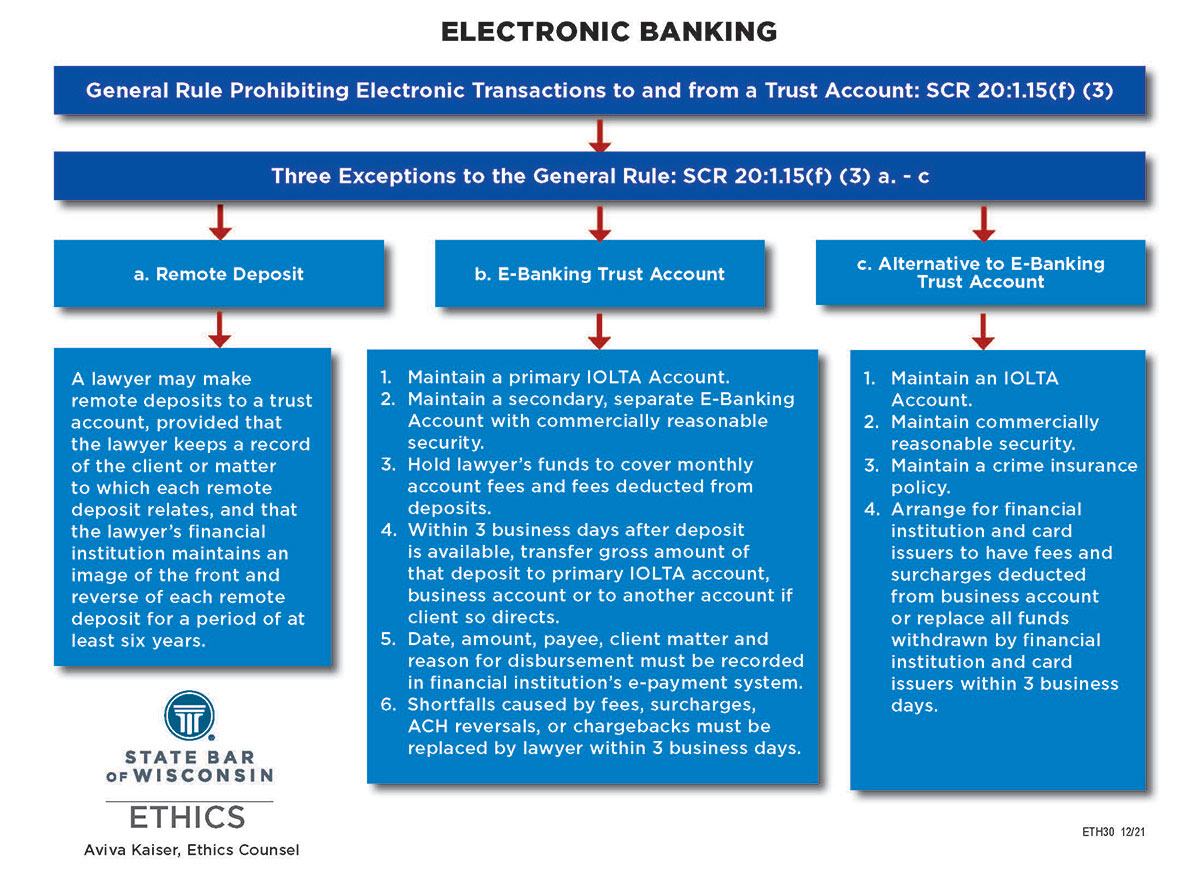

The

Electronic Banking flow chart (see Figure 1) gives you an overview of the general rule in

SCR 20:1.15(f)(3) that prohibits electronic transactions into and out of a Traditional IOLTA Trust Account. The rule outlines three exceptions.

Figure 1: The Electronic Banking flow chart outlines the three exceptions to the general rule prohibiting electronic transactions to and from a trust account.

The three exceptions, found in SCR 20:1.15(f)(3)a.-c., are:

As illustrated in the chart, no electronic transactions are permitted into and out of a traditional IOLTA Account except for remote deposits. “If a lawyer deposits credit card payments or automated clearinghouse payments into a Traditional IOLTA Account, that lawyer has violated SCR 20:1.15(f),” Kaiser says.

“If lawyers wish to accept electronic payments from clients that are required to be placed into a trust account, they should utilize the other two types of trust accounts to process electronic transactions,” says Kaiser.

The Trust Account Options Chart

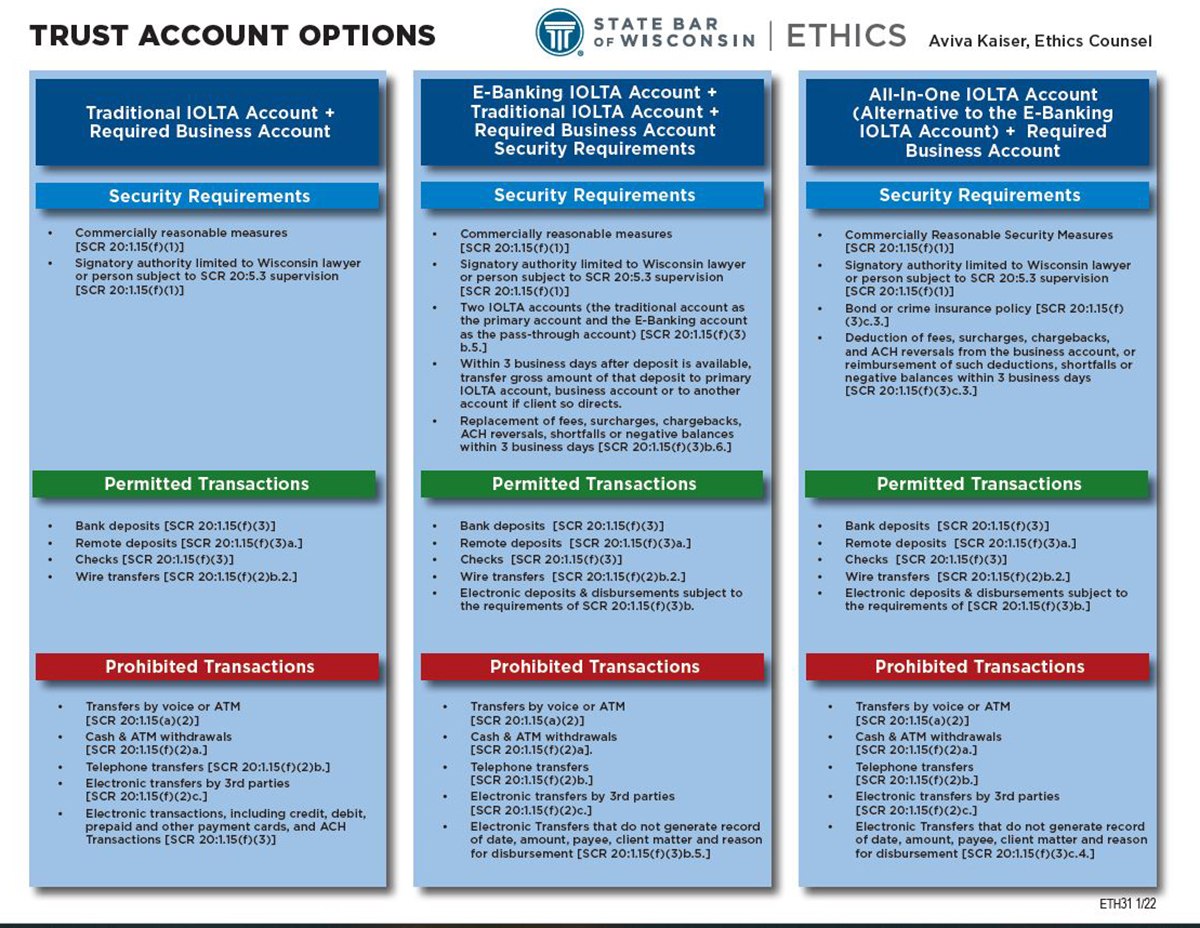

The

Trust Account Options chart (see Figure 2) helps lawyers choose the correct trust account. “The chart compares the security requirements, permitted transactions, and prohibited transactions for each type of trust account,” says Kaiser.

Figure 2: The Trust Account Options chart helps lawyers compare the security requirements and the permitted and prohibited transactions for each type of account.

“Once a choice is made regarding the type of account the lawyer will need, the next step is to look to the third chart to help guide the lawyer through the process of accepting different forms and types of payments from the client,” Kaiser says.

Payment from Client Flow Chart

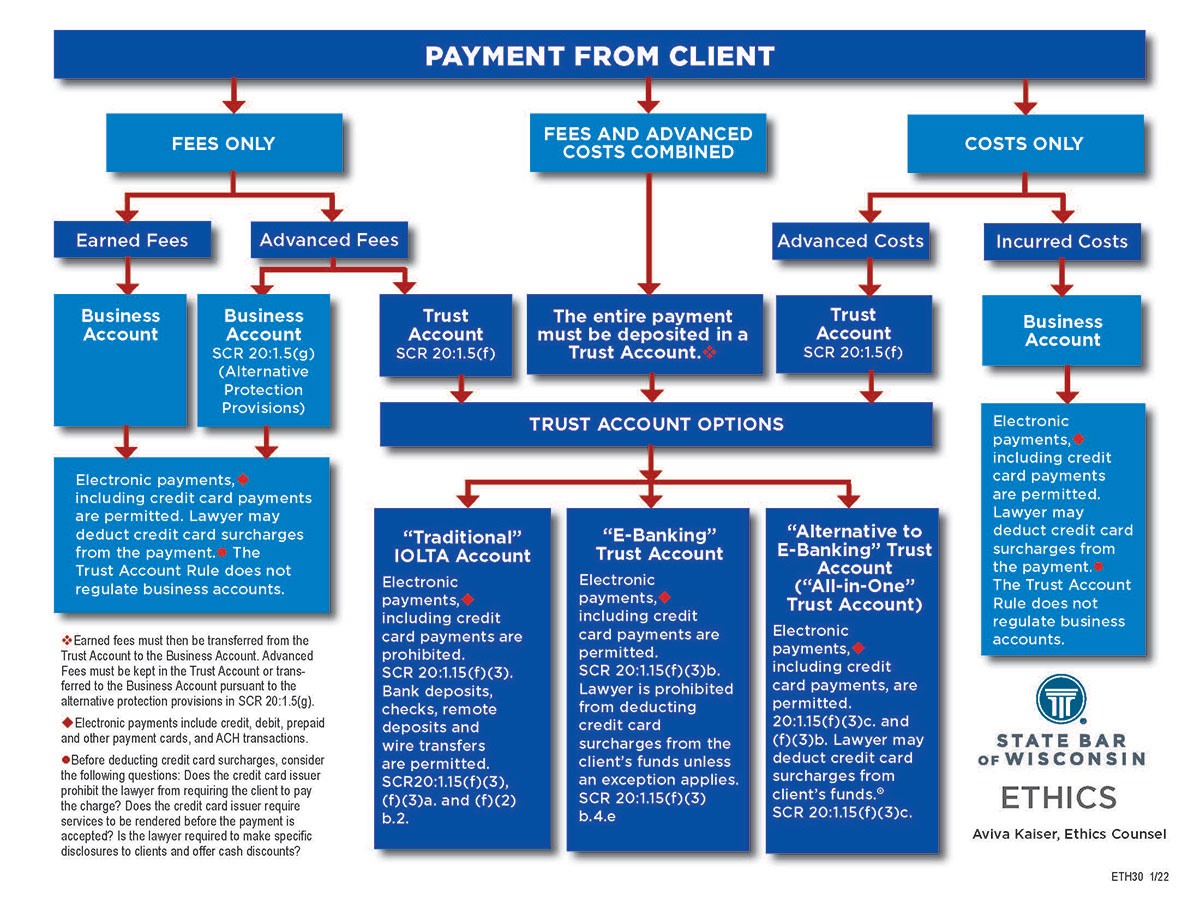

The first step in the

Payment from Client flow chart (see Figure 3) is to identify what the payment from the client is for: whether it is for fees only, fees and costs combined, or costs only, says Kaiser.

“The next steps help the lawyer determine

whether the payment must be deposited into a trust account and then

into which trust account the payment must be deposited,” Kaiser says.

Figure 3: The Payment from Client flow chart helps lawyers determine which types of payments must go into a trust account as well as the type of trust account.

Payments that must be deposited into a trust account, include:

This chart also addresses whether a law firm may hold a client responsible for electronic payment charges associated with processing credit cards.

Lawyers using the alternative to e-banking trust account (the all-in-one trust account) or their business account to process credit card payments may charge their clients with the associated charges, provided they follow the appropriate steps.5

However, lawyers depositing client payments into the e-banking trust account are prohibited from deducting the surcharges from the payment.6

Do you use separate trust accounts for processing electronic payments from your clients? To help lawyers and their staff more easily determine how to properly process payments, State Bar of Wisconsin Ethics Counsel Aviva Meridian Kaiser has created three flow charts: The Electronic Banking chart, Trust Account Options chart, and Payment from Client chart.

A Couple of Helpful Examples

A payment of an earned fee, regardless of the form of the payment (electronic or not) must be deposited into a business account.

Christopher C. Shattuck, Univ. of La Verne College of Law 2009, M.B.A. U.W.-Oshkosh 2015, is manager of

Practice411™, the State Bar’s law practice assistance program. If you have questions about the business aspects of your practice, call (800) 957-4670.

Christopher C. Shattuck, Univ. of La Verne College of Law 2009, M.B.A. U.W.-Oshkosh 2015, is manager of

Practice411™, the State Bar’s law practice assistance program. If you have questions about the business aspects of your practice, call (800) 957-4670.

The same is true for incurred costs: those payments from clients that are meant to reimburse the law firm for costs it has already paid on behalf of the client, such as filing fees, postage, and deposition costs.

The combined payment of an earned fee and reimbursement for a cost the firm has already incurred must also be deposited into the business account, regardless of the form of the payment, as each individual payment would be required to be placed into the business account.7

When a payment from a client consists only of advanced fees – where the lawyer complies with the

alternative protection for unearned fees as permitted by

SCR 20:1.5(g) – those payments must be deposited into the business account regardless of the form of the payment (electronic or not).

However, a combined payment for an advanced fee with an advanced cost must be first deposited into a trust account (because advanced costs must always be deposited into a trust account). The form of payment, whether electronic or not, determines the type of trust account that the payment must be deposited into.

For instance, a client pays a credit card payment of $1,500, with $1,000 as a flat fee and $500 as an advanced cost. Even when the flat fee is subject to alternative protection provisions, this credit card payment must first be deposited into a trust account, such as the e-banking or all-in-one IOLTA.

The same would be true even if the advanced fee is not subject to the alternative protection provisions of SCR 20:1.5(g). This is because advanced costs must always be placed in a trust account.

“We caution lawyers against depositing the entire payment into a business account and then transferring funds to a Traditional IOLTA Account, or using an incorrect trust account to manage all of their transactions, including payments that are not required to be placed into trust. It is a violation of the rules for lawyers to use an incorrect trust account. It is also a violation for lawyers that commingle their own funds8 with that of their clients,” Kaiser says.

Conclusion: Review the Charts, Ask Questions

These charts provide attorneys with the ability to quickly determine which trust accounts are needed to process certain types (fees, costs and commingled payments) and forms of payments (electronic, check, etc.) from clients.

Take the time to review your current processes for accepting and processing client payments through your accounts. If you need advice, contact the State Bar

Ethics Hotline at (800) 254-9154.

If you reviewed the charts and determined that you need to create an additional trust account to handle your client payments,

Practice411 can walk you through the process – call (800) 957-4670.

Learn More: Attend the Electronic Transactions Seminar

Lawyers who accept credit cards, wire transfers, and ACH transactions, must be mindful of the applicable Rules of Professional Responsibility.

For more advice on handling trust accounts and electronic transactions, check out the OnDemand seminar,

Ethical Requirements for Processing ACH, Wire Transfers, and Credit Card Payments, from State Bar of Wisconsin PINNACLE®.

For more information on the seminar,

visit WisBar.org Marketplace and

read the article about the program in the Dec., 1, 2021, issue of

InsideTrack.

Endnotes

1See Timothy J. Pierce, “E-banking: Modernizing Trust Account Rules,”

Wisconsin Lawyer, July 2016.

2See, e.g.,Lawyer Trust & Fiduciary Account Basics 2020,Fee Agreements, Credit Card Payments, and Trust Account Obligations 2020,

Concrete Answers to Common Trust Account Questions 2021, and

Office of Lawyer Regulation Trust Account Management Seminar.

3See, e.g.,Office of Lawyer Regulation Trust Account Manual,

Office of Lawyer Regulation Guidance on Legal Fees and Costs, and

Wisconsin Law Firm Self-Assessment.

4Practice411 provides consultations on how to create trust accounts, and

Ethics Counsel provide consultations on the Supreme Court rules governing trust accounts.

5See, e.g., “Ethical Dilemma: Credit Card Fees – Part III,”

InsideTrack, Oct. 21, 2020, and “Ethical Dilemma: Can Credit Card Fees Be Deducted from Payments into Operating Accounts?,”

InsideTrack, May 20, 2020.

6See “Ethical Dilemma: Can You Add Credit Card Fees to Clients' Bills?,”

InsideTrack, March 18, 2020.

7 A business account is also referred to as an operating account.

8See “5 Tips: Common Trust Account Violations with Travis Stieren,”

InsideTrack, July 7, 2021.