Farm bankruptcies are down. Way down.

The Numbers

Wisconsin

led the nation in Chapter 12 reorganization cases in 2017, 2018, and 2020.

But no more. This reduction in filings is not limited to Wisconsin, however.

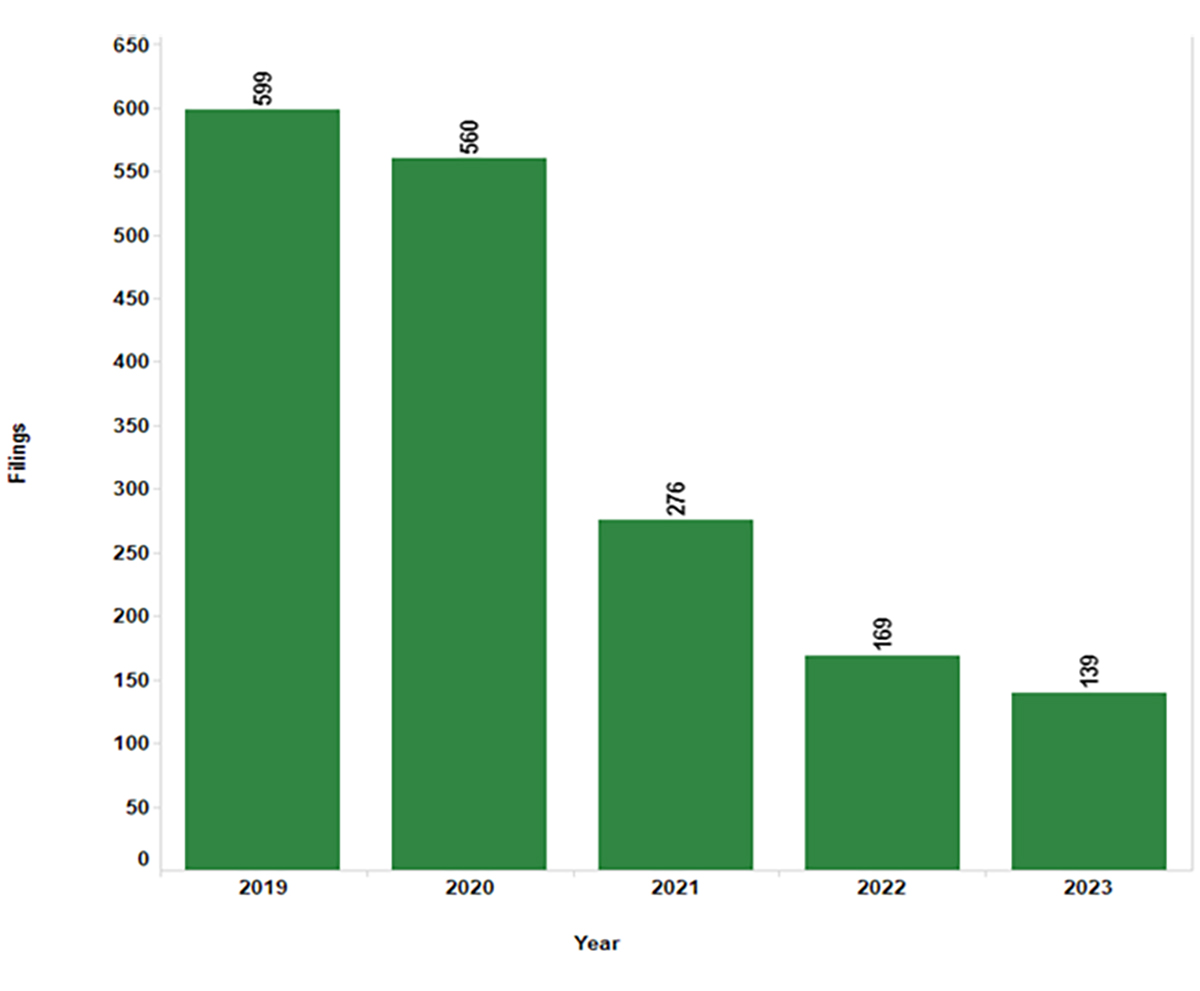

Chart 1, based on data from

uscourts.gov, shows Chapter 12 filings nationwide over the last five years.

Chart 1: National Chapter 12 filings, 2019-23, from a high of 599 in 2019 to 139 in 2023.

Source: uscourts.gov. Click on image to expand.

These are the lowest levels since the Chapter 12 program was made permanent in 2005.

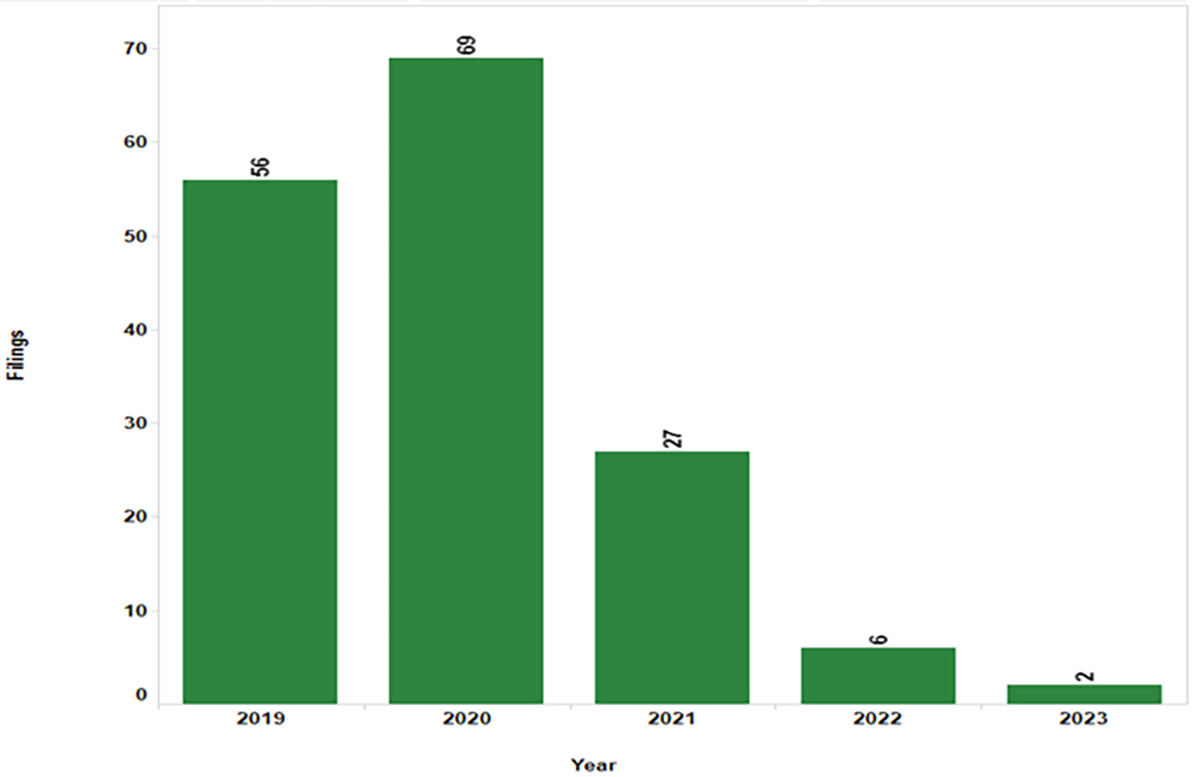

Chart 2, based on data from

uscourts.gov, shows Wisconsin Chapter 12 filings over that same five years.

The Reasons

There are multiple reasons for the drop in farm reorganization filings.

The drop is due in large part to record-breaking farm income in 2022, as high commodity prices and government payments made 2022 an excellent year for many farmers. While income numbers for 2023 were not as high, 2023 ended with net farm income up 7.2% from 2021, and 49% above the 10-year average.

Chart 2: Wisconsin Chapter 12 filings, 2019-23, from a high of 69 in 2020 to two in 2023.

Source: uscourts.gov. Click on image to expand.

Additionally,

steep increases in the price of agricultural land enabled farmers to dip into equity to pay for needed operating expenses or capital improvements.

Despite the rise in income, the farm economy is not completely out of the woods, as farmers are feeling the same inflation costs and pressures felt by all consumers.

So, what else could be contributing to Wisconsin having almost no (only two) farm reorganization cases filed last year?

Subchapter V Bankruptcies

The simple answer may be that other available relief is more attractive. While farm bankruptcies filed under Chapter 12 have been dropping, the number of Subchapter V Chapter 11 cases has grown steadily, and farmers are among the small businesses taking advantage of Subchapter V.

Subchapter V became effective in February 2020 when Congress came to the realization that traditional Chapter 11 was not very effective for small businesses. Congress previously made the same determination with respect to farmers in the 1980s. As a result, Chapter 12 came about because traditional Chapter 11 was not protecting family farms.

Like Chapter 12, Subchapter V provides a streamlined process for restructuring debts, and thus a more efficient and economic means of keeping businesses in business.

Subchapter V is working. Plan confirmation times are much shorter than traditional Chapter 11 cases, and those plans are being confirmed at about double the percentage of traditional Chapter 11 cases. The percentage of cases being dismissed is about 1/2 that of traditional Chapter 11 cases.

For a summary of Subchapter V, see “Small Business Restructuring Act: Simplifying Chapter 11 Bankruptcies,”

InsideTrack, Jan. 15, 2020.

Figure 1: Chapter 12 Compared with Subchapter V

As shown in Figure 1, many of the provisions, powers, and duties are the same in Chapter 12 and Subchapter V.

The biggest difference between the two is the disparity of costs between them. We recently completed a Chapter 12 case for a farmer who filed before Subchapter V was available. The farmer paid over $100,000 in trustee fees. In a Subchapter V reorganization, his trustee fees likely would have been $5,000 to $12,000. However, there will not necessarily be much difference in debtor’s attorney fees under either chapter as those fees are generally driven by the creditors and the issues in each case.

The other significant benefit under Subchapter V is that the discharge may be granted immediately upon confirmation. This requires that the plan be consensual, with creditors voting for the plan. If the plan is not consensual, the discharge is granted upon completion of payments, just as in Chapter 12. According to the Office of the United States Trustee, for cases filed through July 31, 2023, nearly 70% of the confirmed plans had been consensual.

For further illumination, let's look at

what happened with Chapter 11 cases under the new Subchapter V in the last 4 years (this chart, published by justice.gov, only goes back to 2020, as that is when Subchapter V became effective. The 2020 and 2024 records are partial years.)

Note that 2022 was an excellent year for farm profit. A Wisconsin government official involved in agriculture who could not be identified and was speaking off the record, explained that COVID-19 programs provided farmers with a lot of money. Farmers were able to use those funds and expended most of them in 2022, often prepaying expenses therefore making that year a banner year for farmers. While 2023 was stable, the official predicted that we would see more farm financial problems starting in late 2024 and into 2025.

Will Farmers Still Want to File Under Chapter 12?

Two situations give rise to preferring Chapter 12 over Subchapter V:

Debt limit eligibility. Both Chapter 12 and Subchapter V have debt limits. The debt limit for Chapter 12 is $11,097,350. The current debt limit for Subchapter V is only $3,024,725. This limit had been $7.5 million until June 21, when that provision sunset. There is legislation pending to increase it again, and many influential people in the bankruptcy world believe the debt limit should actually increase to at least $10 million.

But in the interim, a number of farmers will have more liquidated debt than is allowed to qualify for Subchapter V.

Favorable tax treatment. Chapter 12 bankruptcy offers special provisions tailored for family farmers. Tax claims that arise due to the sale, transfer, exchange, or other disposition of a farm asset used in the debtor’s farming operation are treated as unsecured claims. In other forms of bankruptcy, including Subchapter V, these tax claims would likely be treated as priority claims and need to be paid in full. Unsecured claims, on the other hand, rarely receive any significant payment.

Conclusion

The total farm debt in 2022 was $496 billion. The following year,

it reached more than $520 billion. With total farm debt expected to grow again this year, the average debt of individual farmers

will likely rise as well.

With the drop in the debt eligibility limit for Subchapter V from $7.5 million to $3,024,725,

we may see more farm bankruptcies. If that debt limit is raised again, though, more and more farmers will end up filing under Subchapter V, primarily due to the cost and discharge benefits.

Still, there can be other benefits to Chapter 12, particularly with regard to tax benefits. This, of course, is why we as practitioners must be aware of all the options and evaluate the cost and benefits for our clients.

Special thank you to Justin Davis, a U.W. Law student who just completed his first year, and to Atty. Eliza M. Reyes of Richman and Richman, LLC, for editing.

This article was originally published on the State Bar of Wisconsin’s

Solo/Small Firm & General Practice Blog of the Solo/Small Firm & General Practice Section. Visit the State Bar

sections or the

Solo/Small Firm & General Practice Section web pages to learn more about the benefits of section membership.