Now that 2018 is in full swing, the question must be asked. Got any new year’s resolutions? I’m not referring to the typical promises, such as exercise more, eat healthier foods, spend more time with family, travel more, or do more volunteer work. Those are all good ideas, no doubt, but it’s also a great time to start thinking about how to improve your law practice – how to best serve your clients, reduce your risk of mistakes, and avoid a malpractice claim or Office of Lawyer Regulation complaint.

Brian Anderson, senior claims attorney at Wisconsin Lawyers Mutual Insurance Co. (WILMIC), says, “It is helpful from a risk management perspective to take a look back at the prior year’s claims data to highlight what areas of practice placed practitioners at the greatest claim risk and what were the types of mistakes that resulted in legal malpractice claims.”

Getting the new year off to a good start might go a long way toward having a successful and prosperous 2018, so let’s review 2017 malpractice claims that came into WILMIC so you can determine ways in which you might want to improve your practice in 2018.

Anderson says, “It appears that claims activity in general remained relatively unchanged in 2017 for us, in terms of the number of claims reported to WILMIC, the amount of money paid out, and the areas of practice that generated the most claims.”

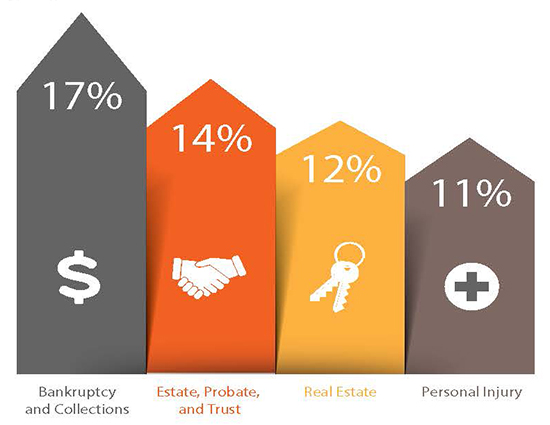

The top four areas of practice that produced the most claims in 2017 were the following: 1) bankruptcy and collections work (17 percent of the claims submitted to WILMIC in 2017); 2) estate, probate, and trust (14 percent); 3) real estate work (12 percent); and 4) plaintiffs’ personal injury work (11 percent).

Anderson points out that bankruptcy and collections, estate planning, and real estate work were all in the top four the previous year, so that did not change in 2017. However, the one change last year concerned family law, which fell out of the top four and was replaced by plaintiffs’ personal injury work.

“This is not a surprising development based on the fact that plaintiffs’ personal injury has remained the most common area of law wherein claims are asserted and the most expensive in terms of indemnity payments paid by WILMIC since its inception in 1986,” Anderson says.

Missed deadlines, which

can often be traced

back to administrative

procedures and

calendaring errors, are

the most common source

of claims. The importance

of a redundant

calendaring system with

frequent file reviews and

client contact can never

be overstated.

Anderson’s takeaway in 2017? “The claims reported last year were more evenly disbursed across all areas of practice. In 2016, 81 percent of all of the claims reported fell within the top four areas of practice, whereas, in 2017, the number of claims asserted within the top four areas of practice dropped to 55 percent of all of the claims that were opened. This represents a change of over 25 percent, reflecting a more even distribution of claims away from the top four areas.”

Anderson says the broader distribution of claims is reflected by several things. “We saw claims asserted in 21 different areas of practice last year. Furthermore, family law, criminal defense, and civil rights discrimination all just missed the top four and collectively represented over 21 percent of the claims reported in 2017.”

From a risk management perspective, it is always interesting (and hopefully helpful) to drill down into the areas receiving the most claims to examine what may have gone wrong to cause a claim to be pursued, and things you can resolve to do to minimize the risk in those areas in 2018.

WILMIC's Top 4 in 2017

A review of 2017 malpractice claims submitted to Wisconsin Lawyers Mutual

Insurance Co. may help you determine where you might want to improve

your practice in 2018.

Bankruptcy and Collections

Starting with the most frequent area for claims, bankruptcy and collection practice, the most common source of claims in 2017 involved alleged breaches of the debtor’s rights. Anderson says this type of claim involves the lawyer’s alleged unlawful disclosure of the debtor’s “personally protected private information” while attempting to collect a debt for the client creditor.

“The fact that these claims come from nonclients in an area of practice that is controlled by a strict liability statute is a headache for the lawyers involved. The collection practice claims that we saw weren’t the result of abusive or harassing collection acts, but rather, minor errors such as inserting the wrong amount into a letter or affidavit, not being careful about venue or the statute of limitation, or the inadvertent disclosure of a credit score or debtor’s driver’s license number.

“We also saw a few claims last year that arose out of the failure to timely file proofs of claims against a bankruptcy estate that ultimately turned out to be more solvent than anticipated. An attorney must carefully flyspeck any collection letters or lawsuits for errors to avoid running afoul of strict liability fee-shifting statutes, which can be both difficult to defend and expensive to resolve when a claim is asserted.”

Estate Planning

The area of practice generating the second largest number of claims in 2017 was estate, trust, and probate practice. Anderson notes, “Although estate planning was not the most frequent area in terms of claims made, this area of practice was by far the most expensive in terms of claim severity, with over 24 percent of the indemnity dollars being spent to resolve these claims last year.”

Anderson says that in the past, the most frequent claim type asserted in this area involved a contention made by a disinherited third party claiming that the lawyer allowed his or her client to execute estate planning documents without the requisite mental capacity to do so or while acting under an undue influence.

Although estate planning was not the most frequent area in terms of claims made, this area of practice was by far the most expensive in terms of claim severity, with over 24 percent of the indemnity dollars being spent to resolve these claims last year.

“Wisconsin law generally protects an attorney from a negligence claim by a nonclient by requiring the showing of an attorney-client relationship. However, there is an exception to that rule in estate planning work that allows claims brought by beneficiaries and would-be beneficiaries of a decedent who are injured as a result of their estate planning choices. We certainly see our share of those type of claims.

“We also saw claims last year that arose out of a lawyer’s failure to account for claims made against an estate that they were handling, to include the failure to timely object to these claims. Attorneys need to be particularly careful, and clearly document the client’s understanding and intent whenever a relative is written out of the client’s current will by a new will or is dropped or diminished between drafts of the client’s estate planning documents.”

Anderson says other common mistakes in estate planning include overcharging a client for estate planning services; failing to inform the client about a tax exposure created by cashing out an IRA trust; and failing to timely file estate tax returns, resulting in IRS penalties and interest.

Real Estate

The third most frequent area for legal malpractice claims in 2017 involved claims against real estate lawyers. Anderson says that clients, with the full benefit of hindsight, can blame lawyers practicing in this area for anything that turns up later to devalue a real estate investment.

“These claims are aggravating to the attorney when the client’s primary goal in the underlying property transaction may not have been to maximize the resale value of the property purchased, transferred, or sold,” he says. “We have also had claims this year caused by boundary disputes, adverse possession, or easement issues that could have been avoided if the parties involved obtained a title opinion prior to the closing.”

If you are not certain that you are willing to pursue the underlying claim to a final resolution, it is far better to turn down the retention at the outset than to accept the case halfheartedly while the statute of limitations closes in.

Finally, real estate lawyers run the risk of conflict-of-interest claims. Anderson points out, “We adjusted several claims last year wherein the aggrieved party to a real estate transaction, who was not represented, later blamed the attorney for allowing his or her client to ‘take advantage’ of them. Full disclosure of exactly what your role is in the handling of the underlying transaction is of paramount importance in avoiding these types of claims, or defending against them if asserted.”

Plaintiffs’ Personal Injury

Finally, the area of practice generating the fourth largest number of claims in 2017 involved plaintiffs’ personal injury law. Even though plaintiffs’ personal injury practice has not been in the top four areas receiving claims for the last several years at WILMIC, overall it remains as the most frequent area of claims and by far the most expensive to resolve in terms of severity since the company began in 1986.

Anderson says the three claim types that helped push this area of law back into the top four are the following:

-

The failure to timely resolve or file a lawsuit, so as to protect a client’s injury claim within the statute of limitation;

-

The failure to protect a client’s ability to pursue an underinsured motorist claim, before resolving the underlying injury claim with the negligent tortfeasor; and

-

The failure to properly advise a client or account for outstanding medical bills or for a Medicare lien interest asserted before the acceptance or disbursement of a personal injury settlement.

Anderson adds, “Clients who have been injured in an accident case can be very emotional and are often facing many stresses at home and at work. If you are not certain that you are willing to pursue the underlying claim to a final resolution, it is far better to turn down the retention at the outset than to accept the case halfheartedly while the statute of limitation closes in.” This can often lead to trouble, Anderson says, “and the end result may not only be an unhappy client, but one ready and willing to bring a malpractice claim as well.”

2018 Resolutions

All of this points to several new year’s resolutions that can help lawyers avoid the same pitfalls others ran into in 2017. Anderson says, “Careful calendaring of client matters and frequent and clear communications with the client remain, as they always have, important risk management safeguards to avoid claims. The analysis in this article supports the fact that missed deadlines, which can often be traced back to administrative procedures and calendaring errors, are the most common source of claims. The importance of a redundant calendaring system with frequent file reviews and client contact can never be overstated.”

Anderson also urges a commitment to good client communication in 2018. “Attorneys are charged with a duty of undivided loyalty to their clients, even after the representation is completed, and that their clients’ confidential information will remain confidential, permanently. The expectation of undivided loyalty and trust places attorneys at a risk for claims that may not have been apparent at the outset of the representation. Clear communication with your client at all stages of the representation is not just good customer service; it will hopefully help you avoid a claim altogether in 2018.”