The limited liability company (LLC) is the predominant business entity structure in Wisconsin, for both new and existing businesses. According to the Wisconsin Department of Financial Institutions (WDFI), over 90% of new business entities organized with the WDFI in 2024 were LLCs.1 The WDFI estimated that as of the end of December 2024, approximately 78.2% of all registered business entities in Wisconsin were LLCs, 13.2% were corporations, and 7.1% were nonstock corporations.2 Because LLCs are the most prevalent form of business entity, understanding LLCs and their legal complexities is of the utmost importance to business litigators and transaction lawyers alike.

This article provides a brief background on the development of the LLC in Wisconsin and the most recent update to the law. Next, this article discusses the limited, existing Wisconsin case law for LLCs, including several insights and surprising findings. Additionally, this article looks at areas under the new LLC law that may be ripe for future litigation and how such disputes can be avoided. Lastly, this article outlines a new federal reporting requirement and how LLCs, and their legal counsel, can prepare for compliance and other best practices.

Two State Bar of Wisconsin PINNACLE publications are important references for attorneys whose practices involve Wisconsin business entities: LLCs and LLPs: A Wisconsin Handbook3 and The Wisconsin Business Entity Handbook.4

Background

Before LLCs were introduced as a form of business entity in Wisconsin, businesses were largely confined to traditional structures: corporations, general partnerships, limited partnerships, and sole proprietorships. Limited liability partnerships (LLPs) were not established until 1995.5

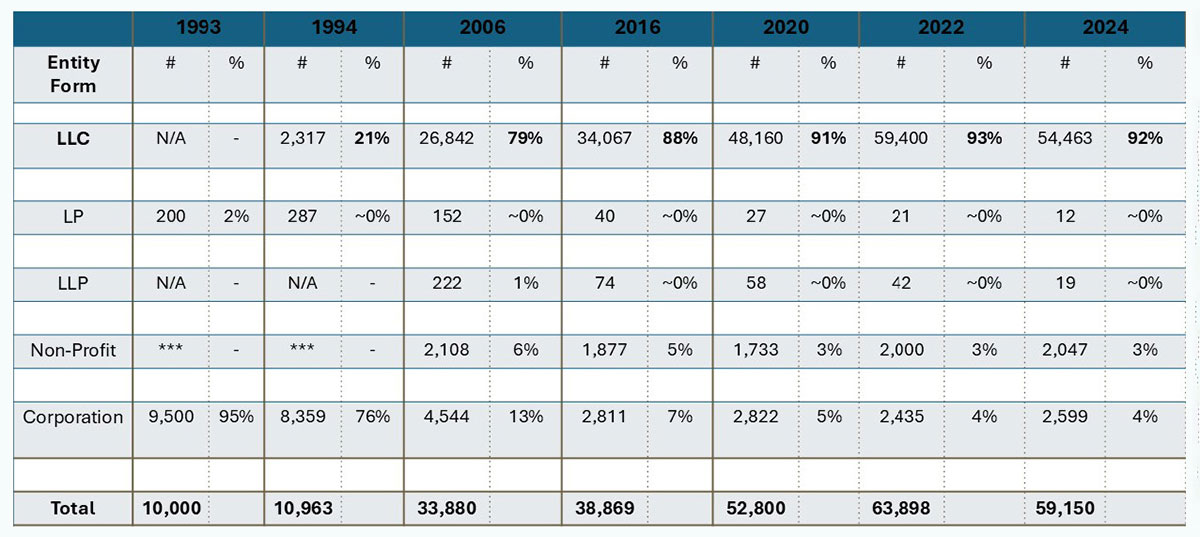

Wisconsin’s LLC law took effect on Jan. 1, 1994. Hereinafter the law is referred to as Wis. Stat. chapter 183 or Chapter 183 (in its initial iteration and as eventually amended). As the accompanying chart illustrates, LLCs became the most popular business form as early as 2001 in Wisconsin. Other than in minor ways,6 Chapter 183 was not substantially changed until a new LLC law went into effect on Jan. 1, 2023. These updates to Chapter 183 (hereinafter the New LLC Law) replaced the old LLC law,7 in an attempt to modernize and align Wisconsin law with the laws of other jurisdictions so that lawyers and courts can look to persuasive case law in the likely absence of binding precedent.8

Under the New LLC Law, existing LLCs were given a choice – to automatically be subject to the New LLC Law when it went into effect or to stay governed by the old LLC law by a filing of non-applicability with the WDFI by Dec. 31, 2022.9 According to the WDFI, 17,368 existing LLCs opted to stay governed by the old LLC law. As such, these entities remain governed by the old LLC law; all other LLCs formed before Jan. 1, 2023, that did not opt to be governed by the old LLC law and all LLCs formed on or after Jan. 1, 2023, are governed by the New LLC Law.

LLC-related Topics That Appear in Case Law

Although LLCs have existed in Wisconsin for just over 31 years, there are only ahandful of opinions, published and unpublished, interpreting provisions of Chapter 183. Exhibit A summarizes many of these cases. While some of the holdings are no longer relevant under the New LLC Law, these cases provide several significant insights.

Joseph W. Boucher, U.W. 1978, is a CPA and a shareholder in Neider & Boucher S.C., Madison, practicing in business law, with an emphasis in emerging and closely held companies. He chaired the State Bar of Wisconsin committee that originally drafted Wisconsin’s LLC law and was active with the committee working on the LLC statute. He also coauthored LLCs and LLPs: A Wisconsin Handbook and Organizing a Wisconsin Business Corporation: Articles, Bylaws, and Other Forms, and the LLC chapter in The Wisconsin Business Law Entity Handbook, all published by the State Bar of Wisconsin. He is a member of the State Bar’s Business Law and Taxation Law sections and the Senior Lawyers Division and is a Fellow of the Wisconsin Law Foundation.

Joseph W. Boucher, U.W. 1978, is a CPA and a shareholder in Neider & Boucher S.C., Madison, practicing in business law, with an emphasis in emerging and closely held companies. He chaired the State Bar of Wisconsin committee that originally drafted Wisconsin’s LLC law and was active with the committee working on the LLC statute. He also coauthored LLCs and LLPs: A Wisconsin Handbook and Organizing a Wisconsin Business Corporation: Articles, Bylaws, and Other Forms, and the LLC chapter in The Wisconsin Business Law Entity Handbook, all published by the State Bar of Wisconsin. He is a member of the State Bar’s Business Law and Taxation Law sections and the Senior Lawyers Division and is a Fellow of the Wisconsin Law Foundation.

Julijana L. Englander, U.W. 2023, is an attorney with Neider & Boucher S.C., Madison, focusing in business law, M&A, health law, employment law, real estate, corporate governance, and business litigation. She is a member of the State Bar of Wisconsin’s Business Law, Intellectual Property & Technology Law, and Labor & Employment Law sections, the Committee on Resolution of Fee Disputes, and the Young Lawyers Division, and the American Bar Association. She co-authored the LLC chapter in The Wisconsin Business Entity Handbook published by the State Bar of Wisconsin.

Julijana L. Englander, U.W. 2023, is an attorney with Neider & Boucher S.C., Madison, focusing in business law, M&A, health law, employment law, real estate, corporate governance, and business litigation. She is a member of the State Bar of Wisconsin’s Business Law, Intellectual Property & Technology Law, and Labor & Employment Law sections, the Committee on Resolution of Fee Disputes, and the Young Lawyers Division, and the American Bar Association. She co-authored the LLC chapter in The Wisconsin Business Entity Handbook published by the State Bar of Wisconsin.

Scarcity of case law and the crucial role of lawyers. The limited number of LLC cases highlights the importance of legal counsel in interpreting and applying LLC law. Lawyers play a vital role in guiding clients through the intricacies of LLC formation, operation, and dissolution.

Judicial education and the need for enhanced legal knowledge. These cases frequently include explanations of fundamental LLC principles; this could indicate that lawyers generally lack knowledge of Chapter 183 and its intricacies, indicating a need for greater legal education within the profession.

Piercing the LLC veil fears unfounded. Early fears that veil piercing in the LLC context would be easier than veil piercing in the corporate context were unfounded; as the case law indicates, there are limited instances of claims for veil piercing, and a case included in Exhibit A discussed veil piercing in the entity-termination context and another discussed how veil piercing may be similar in the LLC context. The New LLC Law should not affect this concern.

Authority and agency: shift in legal framework. Several cases highlight the complexities of determining authority within an LLC. The New LLC Law aligns LLC agency rules with general agency principles, requiring adjustments in how businesses interact with banks, insurance companies, and other entities.

Insurance coverage and parties in litigation. Several cases involve insurance companies clarifying who they are covering and who is the proper party to bring a legal action.

Fiduciary duties. The New LLC Law materially changed fiduciary duties in LLCs.10 These changes may lead to increased litigation, particularly in more complex LLCs with multiple owners and intricate governance provisions. Lawyers must be cognizant that these new provisions require a more thorough evaluation of both how and to what extent fiduciary duties can be limited or waived between and among LLC members and managers compared to the old LLC law.

LLC-related Topics That Are Rare in Case Law

Certain elements of Chapter 183 generally do not arise in the case law, such as the following:

Entity formation. No Wisconsin case addresses the intricacies of entity formation, which is surprising given the inherent complexity of determining member contributions and their corresponding ownership allocations.

Entity termination. Entity termination is scarcely addressed, with only one case found, and that solely within the context of piercing the corporate veil. Furthermore, this case, New Horizons,11 highlights that dissolved LLCs possess the option, not the obligation, to file articles of dissolution and public notice to reduce the statute of limitation. In the authors’ experience, entities sometimes dissolve or vanish without clients undertaking these formal steps. Although this may save money in the short term, it can lead to future legal risks.

Administrative dissolution. The legal implications of administrative dissolution, a common occurrence, are notably absent from case law. In 2024 alone, over 36,000 LLCs were administratively dissolved, according to the WDFI. Many administrative dissolutions might be unintentional, but as a result, businesses may be unknowingly operating as sole proprietorships or general partnerships, incurring unintended liabilities. Although reinstatement is possible,12 dissolved LLCs infrequently file for reinstatement; in 2024, just over 3,000 LLCs filed for reinstatement according to WDFI records. Moreover, the shift to email notifications under the New LLC Law13 raises concerns about deliverability and potential oversight; for example, how many of these notifications are delivered to nonexistent email addresses or get stuck in spam filters? The authors recommend annual WDFI status checks for clients, by legal counsel and by tax professionals, to mitigate the risks of delinquency and inadvertent dissolution.

Mergers, reorganizations, and conversions. Despite the complexity inherent in mergers, reorganizations, and conversions, there is a notable absence of judicial precedent on these topics. While the business law components of these transactions are often less intricate than the tax aspects, it is crucial to recognize that these actions can trigger significant, unintended tax consequences for clients. Lawyers must prioritize the identification and mitigation of potential tax risks associated with these changes.

Exhibit A: List of LLC Cases and Summaries

1999: New Horizons Supply Co-op. v. Haack, No. 98-1865, 1999 WL 33499 (Wis. Ct. App. Jan. 28, 1999) (unpublished)

The Wisconsin Court of Appeals held that if an LLC dissolves without properly giving notice to creditors, as outlined under Wis. Stat. chapter 183, creditors are permitted to sue members of the LLC personally for outstanding debts. In sum, failure to follow dissolution procedures leaves LLC members personally vulnerable to creditor claims via piercing of the LLC veil.

2005: Brown v. MR Group LLC, 2005 WI App 24, 278 Wis. 2d 760, 693 N.W.2d 138

The Wisconsin Court of Appeals examined how comprehensive general liability (CGL) policies should be interpreted as they apply to Wisconsin LLCs with respect to “named insured” language. The court held that “manager” and “member” within CGL policies for Wisconsin LLCs must be interpreted in accordance with Wis. Stat. chapter 183; however, terms, such as “real estate manager,” that are not defined under Wis. Stat. chapter 183 retain their common dictionary meaning. The ruling that LLC-specific policy terms are governed by statutory definitions provides more consistency and predictability in insurance coverage.

2005: Gottsacker v. Monnier, 2005 WI 69, 281 Wis. 2d 361, 281 Wis. 2d 361

The Wisconsin Supreme Court held that LLC members with conflicts of interest can vote on asset sales, provided they do not intentionally harm the LLC or its members and that an LLC member with a material conflict of interest must deal fairly with the LLC and its members.

2005: Lenticular Europe LLC v. Cunnally, 2005 WI App 33,279 Wis. 2d 385, 693 N.W.2d 302

The Wisconsin Court of Appeals established that a minority member of an LLC under Wis. Stat. chapter 183 has standing to pursue a derivative action when 1) the LLC’s operating agreement does not expressly prohibit such actions; and 2) the majority member’s interests are opposed to those of the LLC, requiring the majority member’s vote to be excluded for this purpose.

2007: Kasten v. Doral Dental USA LLC, 2007 WI 76, 301 Wis. 2d 598, 733 N.W.2d 300

Wis. Stat. chapter 183 allows members, at their own expense and with proper request, to inspect and copy company records, except as reasonably restricted by an operating agreement. While emphasizing the statute’s intent to uphold freedom of contract and enforce operating agreements, especially when the operating agreement differs from default rules, in Kasten, the Wisconsin Supreme Court affirmed this principle within the context of document-inspection requests.

2009: Sanitary District No. 4-Town of Brookfield v. City of Brookfield, 2009 WI App 47, 317 Wis. 2d 532, 767 N.W.2d 316

The Wisconsin Court of Appeals emphasized the flexible nature of LLCs under Wis. Stat. chapter 183. The court prioritized member intent and substantial compliance with operating agreements over strict formalities to reinforce the principle of flexibility in LLC management and decision-making.

2011: Executive Center III LLC v. Meieran, 823 F. Supp. 2d 883 (E.D. Wis. 2012)

The U.S. District Court for the Eastern District of Wisconsin established that common-law fiduciary duties are presumptively applicable to LLCs, not just those fiduciary duties explicitly stated in Wis. Stat. chapter 183.

2013: Jones v. Nutting, No. 2012AP811, 2013 WL 3306081 (Wis. Ct. App. July 2, 2013) (unpublished)

The Wisconsin Court of Appeals examined the legal principle that an LLC is a separate legal entity and determined that an LLC must be represented by an attorney in legal proceedings in Wisconsin. An individual cannot pursue legal claims on behalf of an LLC when the claims belong to the LLC itself.

2015: Dreifuerst v. Wisconsin Movers Supply Co., No. 2013AP2087, 2015 WL 4111788 (Wis. Ct. App. July 9, 2015) (unpublished)

This unpublished opinionsignificantly affects LLC law by reinforcing the statutory obligations of LLCs to maintain and provide members with access to crucial records. The court imposed substantial contempt sanctions for the LLC’s failure to comply with document-production orders. The ruling in Dreifuerst underscores the judiciary’s power to enforce these orders and clarifies that LLCs, akin to corporations, cannot evade record production by claiming loss or destruction but must demonstrate reasonable efforts to replace them, thereby solidifying the accountability and transparency required of these business entities.

2017: Smith v. Kleynerman, 2017 WI 22, 374 Wis. 2d 1, 892 N.W.2d 734

The Wisconsin Supreme Court split (3-3) and thereby affirmed the Wisconsin Court of Appeals’ holding that an LLC officer owed fiduciary duties to the business and to other owners.

2018: Schaefer v. Orth, No. 2017AP893, 2018 WL 1738752 (Wis. Ct. App. Apr. 10, 2018) (unpublished)

The Wisconsin Court of Appeals addressed the liability of an LLC manager for the LLC’s debts. The court held that the manager was not personally liable for the LLC’s unpaid debts. Despite a jury finding that the manager breached the LLC’s operating agreement, the court emphasized that managers are shielded from personal liability for company debts unless they act outside their managerial capacity.

2019: Marx v. Morris, 2019 WI 34, 386 Wis. 2d 122, 925 N.W.2d 112

The Wisconsin Supreme Court expanded LLC member liability by ruling that members and managers owe common-law fiduciary duties to each other and the LLC. Notably, the court eliminated the need for derivative actions – it determined that individual members can directly sue other members for harm to the LLC.

2019: Raab v. Wendel, Case No. 16-CV-1396, 2019 WL 3001632 (E.D. Wis. July 10, 2019) (unpublished)

The Eastern District court reconsidered its stance on fiduciary duties within LLCs, acknowledging the effect of Marx v. Morris. However, the court also clarified that even after the Marx decision, majority members of an LLC do not have a common-law breach-of-fiduciary-duty claim against minority members. Ultimately, the case proceeded to a jury trial, but the court’s decision underscores the importance of clear management agreements and the nuanced application of fiduciary duties in LLC operations.

2020: Skyrise Construction Group LLC v. Global Water Center II LLC, No. 2019AP425, 2020 WL 357181 (Wis. Ct. App. Jan. 22, 2020) (unpublished)

The Wisconsin Court of Appeals ruled that a subcontractor cannot sue a property owner (an LLC) for payment when the subcontractor’s contract was with the general contractor. The court stressed the LLC’s separate legal status and the need for direct contractual ties, rejecting claims based on indirect relationships.

2021: Mathison v. Kulhanek, No. 2019AP1568, 2021 WL 329930 (Wis. Ct. App. Feb. 2, 2021) (unpublished)

The Wisconsin Court of Appeals addressed whether an LLC member was an “insured” under the LLC’s CGL policy for actions related to the member’s personal real estate rental agreement. The court held that the member’s actions were outside the scope of the LLC’s business operations and thus were not covered by its insurance. This decision clarified that LLC membership does not automatically extend insurance coverage to all personal actions; the actions must be within the LLC’s business scope.

2023: Pagoudis v. Keidl, 2023 WI 27, 406 Wis. 2d 542, 988 N.W.2d 606

This case involved a real estate transaction and claims of misrepresentation against the seller; the case “[gave] rise to confusion because of three legally distinct entities… [and] conflated their interests.” In the suit, the plaintiff brought claims on behalf of three parties – himself in his individual capacity and as the sole owner of two LLCs. The Wisconsin Supreme Court, citing a book by article coauthor Joseph Boucher, noted that “although an LLC is an association of members,” Chapter 183 treats LLCs as distinct legal entities separate from their members and “the plaintiffs’ legal interests are not collective.” The court ultimately held that only the party to the contract in the transaction had standing to bring claims against the seller.

2024: Alurf v. Johnson LLC, No. 2023AP537, 2024 WL 3355191 (Wis. Ct. App. July 10, 2024) (unpublished)

The Wisconsin Court of Appeals clarified the legal consequences of a member’s dissociation from an LLC. The court held that an individual, upon tendering written notice, was no longer a member of the LLC, no longer could take legal action to enforce rights that only apply to members, and no longer could object to post-dissociation dealings, even if contractual financial obligations remained outstanding.

2024: City of Wautoma v. Marek, No. 2023AP1054, 2024 WL 1776444 (Wis. Ct. App. April 25, 2024) (unpublished)

The Wisconsin Court of Appeals held that Wis. Stat. chapter 183 protected an LLC member of a single-member LLC from personal liability for the LLC’s zoning violations, reinforcing the principle of limited liability.

2025: Garrett v. Ocean View Swimming Pool Services LLC, 2025 WI App 12, ___ Wis. 2d ___, ___ N.W.3d ___

The Wisconsin Court of Appeals reversed a lower court ruling, which had shielded the defendant, a member of a member-owned LLC, from personal liability for negligent actions by that member. The court remanded the case, noting that, under relevant corporate-veil-piercing case law, a corporate officer may be personally liable for their own negligent acts like any other employee and that the plaintiff’s claims centered on the defendant’s individual negligent acts, not negligent actions of the entity.

The New LLC Law

Under the New LLC Law, operating agreement is defined as “the agreement, whether or not referred to as an operating agreement and whether oral, implied, in a record, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in [Wis. Stat. §] 183.0105 (1). The term includes the agreement as amended or restated.”14 This broad definition raises concerns regarding the scope of documents considered operating agreements. Potentially within the realm of “operating agreement” are tax returns, which list the owners and include important information such as profit and loss sharing; and emails and other correspondence between clients, lawyers, and CPAs, which might contain provisions that fall within the scope of an operating agreement. While attorney-client privilege protects communications with legal counsel, CPA-client and third-party communications lack similar protection, creating a risk of disclosure. For example, correspondence with a bank, insurance agent, or other external agents could provide evidence that impliedly amends or replaces a written operating agreement.

Given the new definition of operating agreements, and that operating agreements now might be amended impliedly, this area is ripe for litigation and significant problems for LLCs, particularly in the areas noted below.

Member-managed versus manager-managed. Under the New LLC Law, the articles of organization no longer require organizers to select between member-managed or manager-managed.15 This designation is now made in the written operating agreement; if no such written operating agreement exists or if the agreement is silent, the LLC defaults to member management.16 To avoid confusion or governance disputes, the authors recommend making the member-managed or manager-managed distinction in a written operating agreement.

Limit of fiduciary duties. While the New LLC Law permits the limitation of fiduciary duties, such limitations must be expressly stated in a written agreement.17 This provision is particularly critical in complex business affiliations.

Major decisions. By default, certain fundamental actions require unanimous member consent, effectively granting minority members veto power, including, but not limited to, the following:18

Amendment to the articles of organization or operating agreement;

Merger, reorganization, conversion, or similar actions;

Addition or acceptance of new members;

Acceptance of additional capital contributions;

Issuance of a transferable interest in the LLC; and

Valuation of contributions of the members.

Applying the correct law. When working with LLCs formed before Jan. 1, 2023, whether as a lawyer taking on a new LLC client or a lawyer working on a transaction with such an LLC in a merger or an acquisition, the lawyer must check the WDFI’s records to determine whether the entity elected to remain governed by the old LLC law.

LLCs and S corporation elections. Many entities formed as LLCs operating as partnerships for tax purposes later elect to be taxed as S corporations, often because this change is suggested by the entity’s tax advisor. Often, lawyers learn about the change well after the fact. The authors drafted an operating agreement for an entity when the entity was a partnership; the entity now is taxed as an S corporation. Clearly this can be problematic. This situation occurs frequently.

Lawyers should proceed with caution when drafting an operating agreement or advising on governance for any LLC that may be taxed as an S corporation. Some provisions in operating agreements can unintentionally invalidate S elections. These include sections regarding the following:

Membership – S corporations cannot have more than 100 members, and corporations, LLCs, partnerships, or certain trusts are prohibited from being owners;19

Classes of units – S corporations can only have one class of stock;20 and

Proportions of members’ distributions, income, and deductions – all shares must “confer identical rights to distributions and liquidation proceeds.”21

Whether the class-of-shares and proportionate-rights requirements are met depends upon “the corporate charter, articles of incorporation, bylaws, applicable state law, and binding agreements relating to distribution and liquidation proceeds.”22 In the LLC context, the operating agreement, articles of organization, and other binding agreements are used to determine whether the entity meets S corporation requirements. Therefore, lawyers must scrutinize these documents because any provisions in an entity’s governing documents that are inconsistent with certain S corporation requirements can threaten or revoke an entity’s S corporation election.23

Despite these areas of concern, it remains clear that LLCs will continue to dominate the business entity landscape. Lawyers must therefore maintain familiarity and proficiency with the New LLC Law and, to a lesser extent, the old LLC law to best serve their clients.

Exhibit B: Wisconsin Entity Formation by the Numbers

Corporate Transparency Act

Another recent development at the federal level will have a significant effect on Wisconsin entities and makes understanding LLC law vital for business litigators and transactional lawyers alike. The Corporate Transparency Act and the federal regulations promulgated under it (collectively, the CTA) place reporting requirements on most entities and closely held businesses organized or operated in the United States.24

The CTA was enacted on Jan. 1, 2021, with the goal of reducing terrorist financing, money laundering, and other illicit activities. The CTA requires millions of entities, referred to in the CTA as “reporting companies,” to file information about themselves, about each “beneficial owner” (defined as each individual who directly or indirectly owns 25% or more of the reporting company’s interests or who exercises substantial control over the reporting company, either directly or indirectly), and, in many instances, about the “company applicant” (defined as the person who filed or effected the reporting company’s formation or registration with a state entity).25

While the future of the CTA remains uncertain,26 the authors believe that if the CTA goes into effect as written, it will have the following effects:

(Nearly) universal filing obligation: The majority of LLCs are subject to the CTA.27 Consequently, a systematic review of existing clients and a mandatory compliance check for all new clients are essential to accurately determine if the entity is a reporting company and if so, who are the beneficial owners.

Lawyers as company applicants: Lawyers frequently organize entities by filing the requisite paperwork with state agencies; this necessitates including lawyers in the filing as a company applicant. Lawyers who frequently organize entities for their clients should obtain a FinCEN number.

Broad transactional implications: New LLC formations will typically require a filing within 30 days.28 This presents challenges when beneficial owners are not immediately established – clients might not know who the owners are during that period, but they must file the report anyway. As ownership changes in the entity or information for beneficial owners changes, the reporting company must file subsequent reports to amend or correct any changes.29 Operating agreements and other key entity documents must be updated to include provisions mandating owners to provide the required information and documentation for the entity to comply.

Mergers and acquisitions: Business acquisitions, sales, and mergers must incorporate robust representations and warranties regarding past compliance covenants on future compliance.

More information on the CTA and its effects on Wisconsin business entities is available from many sources, including the following: “Corporate Transparency Act: Prepare for Compliance Now”30 and “Your Guide to the Corporate Transparency Act 2023.”31

Conclusion

Given that LLCs are the most prevalent form of business entity, it is crucial for lawyers to understand not only the intricacies of Chapter 183 but also how these nuances affect and interact with other requirements, such as the CTA.

Representing Clients with Limited Liability Companies: Two State Bar of Wisconsin PINNACLE Resources

Join the many attorneys who focus in business law or have general practices and who rely on LLCs and LLPs: A Wisconsin Handbook to stay informed on these important and popular business entity options. You’ll find detailed discussions on choosing the appropriate business entity, organizing a business, business formalities, and operational and tax issues.

Join the many attorneys who focus in business law or have general practices and who rely on LLCs and LLPs: A Wisconsin Handbook to stay informed on these important and popular business entity options. You’ll find detailed discussions on choosing the appropriate business entity, organizing a business, business formalities, and operational and tax issues.

You’ll also find thorough analysis of topics including default pass-through treatment under “check-the-box” regulations, the authorization of single-member LLCs, and the rule permitting Wisconsin lawyers to use LLCs and LLPs for their practices. Both the print and Books UnBound versions come with a complete set of fillable forms, including operating, member, and partner agreements.

wisbar.org/AK0065

LLCs also are discussed in The Wisconsin Business Entity Handbook, which outlines the key issues you’ll need to analyze to determine which structure fits the client’s unique circumstances and compares each entity type based on organizational, operational, and taxation considerations.

LLCs also are discussed in The Wisconsin Business Entity Handbook, which outlines the key issues you’ll need to analyze to determine which structure fits the client’s unique circumstances and compares each entity type based on organizational, operational, and taxation considerations.

Following the recent overhaul of Wisconsin’s business entity statutes, the Handbook offers timely clarity on essential requirements for creating entities, including required forms; tax consequences of choosing a particular entity; necessary reporting responsibilities or annual filings; possible management and governance styles for the new entity; fiduciary duties, rights, and limitations on ownership; and potential for personal and financial liability.

New lawyers will find the Handbook useful for evaluating clients’ business goals and selecting the right entity for their needs. Experienced attorneys will appreciate the clear comparisons of entities to determine the best structure for each unique situation. The Handbook’s focus on Wisconsin law also makes it a valuable resource for out-of-state lawyers with clients operating in Wisconsin.

wisbar.org/AK0443

Endnotes

1 This number excludes sole proprietorships and general partnerships, which are not required to register or organize.

2 1995 Wis. Act 117, creating Wis. Stat. ch. 178.

3 Joseph W. Boucher et. al., LLCs and LLPs: A Wisconsin Handbook (State Bar of Wis. 8th ed. 2023 & Supp.).

4 Nathaniel S. Hammons et. al., The Wisconsin Business Entity Handbook (State Bar of Wis. 2024).

5 1995 Wis. Act 117.

6 Despite being amended 22 times since it took effect, Chapter 183 was largely substantively unchanged until the New LLC Law was enacted. The only substantial alterations were part of the 2002 amendment, which granted Wisconsin LLCs perpetual life and enabled cross-species mergers. See Boucher, supra note 3, § 1.11.

7 In 2022, Governor Tony Evers signed into law Senate Bill 566 to modernize and update the state’s business entity statutes, including updates to Chapter 183.

8 See Joseph W. Boucher et al., Reflections A Look Back and Ahead: The Wisconsin Limited Liability Company, 95 Wis. Law. 47 (June 2022).

9 Wis. Stat. § 183.0110(2)(b).

10 Wis. Stat. § 183.0402 (2019); Wis. Stat §§ 183.0409(2)(a)-(c), 183.0105(4).

11 New Horizons Supply Co-op. v. Haack, 224 Wis. 2d 644, 590 N.W.2d 282 (Ct. App. 1999).

12 Wis. Stat. § 183.0709.

13 Wis. Stat. §§ 183.0115(2), 183.0119(1).

14 Wis. Stat. § 183.0102(13).

15 Wis. Stat. § 183.0201(2).

16 Wis. Stat. § 183.0407(1).

17 Wis. Stat. §§ 183.0105(4), 183.0409; compare Wis. Stat. § 183.0402 (2019).

18 Wis. Stat. § 183.0407(2), (3).

19 I.R.C. § 1361(b)(1)(A)-(C).

20 I.R.C. § 1361(b)(1)(D).

21 Treas. Reg. § 1.1361-1(l)(1).

22 Treas. Reg. § 1.1361-1(l)(2)(i).

23 See Hammons, supra note 4, ch. 5.

24 See Kent L. Schlienger, Corporate Transparency Act: Prepare for Compliance Now, 96 Wis. Law. 10 (Dec. 2023).

25 Id; see 31 U.S.C. § 5336(a)(11); 31 C.F.R. § 1010.380.

26 Mengqi Sun, Corporate Transparency Act Still Blocked Despite Supreme Court Decision, Wall St. J., Jan. 24, 2025, https://tinyurl.com/4xr6h7hj; Mengqi Sun, Trump Administration Curbs Enforcement of the Corporate Transparency Act, Wall St. J., Mar. 3, 2025, https://tinyurl.com/4ztb25du.

27 87 Fed. Reg. 59500 (Sept. 30, 2022).

28 31 C.F.R. § 1010.380(a)(1)(i)-(ii).

29 31 C.F.R. § 1010.380(b)(3).

30 See Schlienger, supra note 24.

31 State Bar of Wis., “Your Guide to the Corporate Transparency Act 2023” (available as on-demand seminar).

» Cite this article: 98 Wis. Law. 16-23 (April 2025).